What Does the Social Security Fairness Act Do?

fyi50+: Dave, in our last article about Social Security Offsets, we discussed the pending legislation in the House of Representatives that would eliminate two provisions of the Social Security system. The two offsets are the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO). These two offsets are now history. How does this affect people in the states impacted by this new policy law?

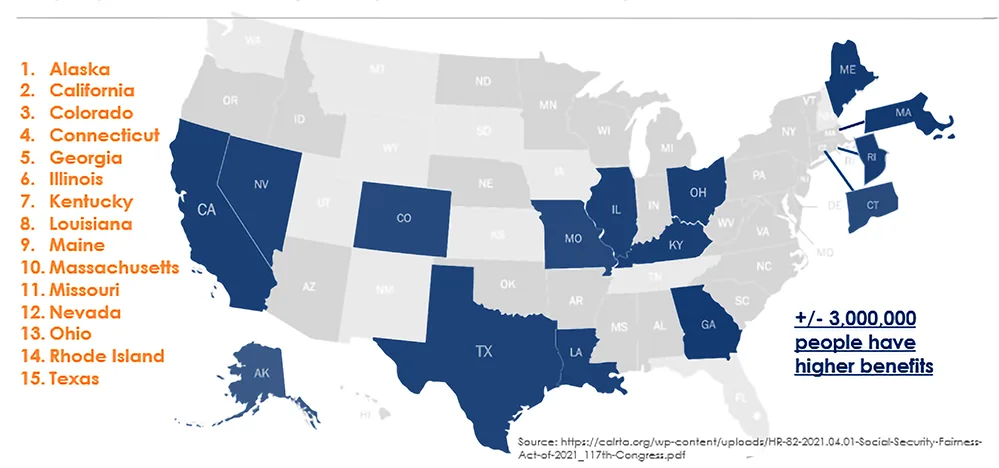

Freitag: Heidi, you are correct. On January 5, 2025, President Biden signed the bipartisan Social Security Fairness Act into law. This new law eliminated both the Windfall Elimination Provision and the Government Pension Offset provisions of the Social Security law. The new law has created dramatic potential increases in Social Security benefits for public employees in Texas and 14 states nationwide who paid into the state retirement system. *See graphic at the end

fyi50+: That sounds like excellent news for many retirees in the specific states. How exactly does this act boost their benefits?

Freitag: Yes, it is. Before the law was passed, public employees like teachers, firefighters, police officers, and other state administrators could have experienced reduced Social Security benefits from their work records because they paid into the State retirement system. In addition, they might have experienced dramatic reductions in spousal and/or survivor benefits they might have expected to receive from their spouses because they were drawing a retirement benefit from the state.

fyi50+: Can you provide a real example of what the Social Security Fairness Act does to change that?

Freitag: Let’s consider a married couple, Bob and Mary, who live in Texas, one of the states most affected by the recently enacted act. Bob worked for a private company and paid Social Security taxes throughout his career. Meanwhile, Mary was employed in the private sector for 10 years and contributed to the Social Security system. Later, she switched careers to become a teacher in the Texas school system, contributing to the TRS system instead of Social Security. When Bob retired, he received a monthly Social Security benefit of $3,500. Mary gets a monthly retirement benefit from the Social Security system of $1,200 and $3,000 from the state system. Before the law changed, Mary’s Social Security benefit from her non-teaching career was subject to the WEP offset of up to $584 (or 50% of her full retirement age benefit, whichever is smaller) each month, according to a formula established by the Social Security system. This posed a challenge for Mary, but the GPO offset was even more detrimental. In the future, if she outlives Bob, the survivor benefit from Bob’s Social Security account would be reduced by two-thirds of her state pension. Consequently, her Social Security survivor benefit from Bob would not be $3,000 per month; instead, it would be reduced by $1,980 to $1,020. If her Texas benefits were higher, the Social Security survivor benefit could potentially be lowered to zero.

fyi50+: In this example, what is the result of this new change in the law for Bob and Mary?

Freitag: Now, Mary will not have a WEP reduction of benefits from her own Social Security work record. If she outlives Bob, she will receive her full survivor benefit from him because the Government Pension Offset is no longer in effect. This much higher survivor benefit will make a big difference in Mary’s income when Bob is gone.

fyi50+: This has to be great news!

Freitag: This is terrific news, especially for those subject to WEP and GPO offsets. But it does have a downside. The Social Security Administration has estimated that the removal of the offsets will cost up to $196 billion over the next ten years. This extra cost will be paid out of the Social Security trust fund, which could cause the trust fund to run out of money six months earlier than previously projected.

fyi50+: So, what happens now?

Freitag: The government has an informative webpage that will guide you on what to do if the Social Security Fairness Act affects you.

This site is frequently updated with news about the next steps. Be sure to check it out. Thousands of previously unavailable dollars are now available to many retirees in the affected states.

The Social Security Fairness Act of 2025 benefits public employees, including teachers, police, firefighters, and some federal employees in these states: