Think You’d Never Fall for a Scam? Think Again!

As covered in this space a while back, how bad guys take advantage of us is constantly changing.

The new technology provides scammers with new tools. However, while the tools may evolve, the tactics behind them remain similar.

Scam Tactics: recognizing fake urgency and high-pressure tricks

Fraudsters rely on fake urgency—like unpaid tolls, overdue taxes, or a jailed grandchild. If anyone pressures you to pay immediately or refuses in-person payment, that’s a red flag.

According to scam expert Frank Abagnale, one tactic is asking that money be handed over immediately.

(If that name sounds familiar, it’s because he was portrayed by Leonardo DiCaprio in the film Catch Me If You Can. The movie is based on the book of the same name, which Abagnale co-wrote.)

You’ll see the same fake urgency with the scam involving unpaid highway tolls. A similar example is someone claiming to be from the IRS, demanding immediate payment of unpaid taxes. A third example is the scam involving a grandchild who needs to post bail now, or they’ll spend the weekend in jail.

“If the father or the grandparent says: ‘Look, I live one block away; let me just walk down to the sheriff’s office, and I’ll pay the bond.’ [And they reply:] ‘No, you can’t do that. You have to give me a credit card over the phone.’ … Right there, that’s a huge red flag,” said Abagnale.

Another red flag, he added, is being asked for sensitive data such as personal or financial information.

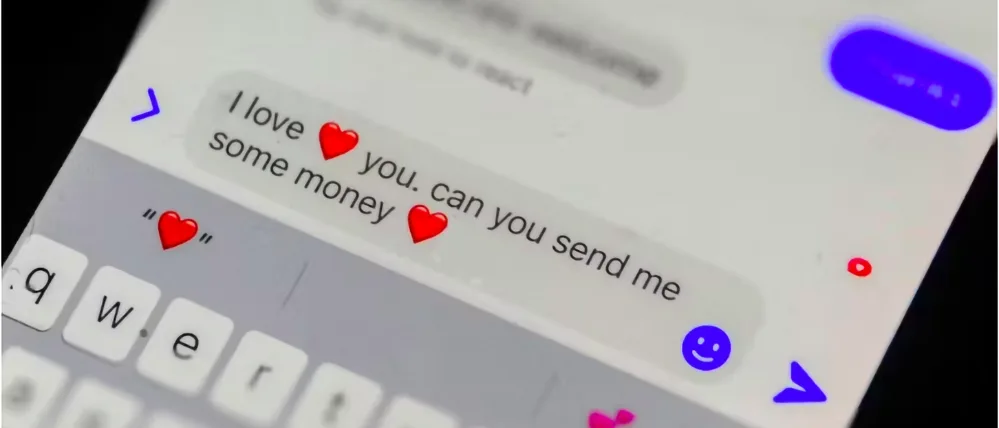

Charm, lies, and romance scams

Some scammers “put people under ether” — using affection, flattery, or promises of prizes to build trust.

Abagnale also warns of something he calls “putting people under ether,” or charming a target into thinking that the scammer is worthy of their trust or even their love. Some scammers can be so charismatic that a target, even when confronted with evidence to the contrary, will insist the scammer isn’t taking advantage of them.

The so-called “ether” can appear as good news out of the blue—such as being told you’ve won a contest you don’t remember entering. For instance, the promise of a fancy new car can be too intoxicating for some to snap back into reality.

“It amazes me how many very intelligent people — doctors, lawyers, and business professionals — fall for these scams,” he said.

AI is helping scammers sound smarter

Artificial intelligence tools can now make scam emails and texts look more legitimate — but if something feels “off,” trust your instincts.

Scammers are not great writers or editors; their misspellings and grammatical errors can serve as additional red flags. However, the increasing use of AI presents a new challenge, as it can make texts and documents appear more convincing.

Top tips to protect yourself right now

Stay ahead of fraud with these smart, actionable moves:

- Freeze your credit (and your children’s if they’re not applying for loans or buying homes)

- Use credit cards, not debit cards— they offer far more protection

- Sign up for credit monitoring that covers all three bureaus and offers real-time alerts

- Don’t link your bank account or debit card to payment apps like Venmo or Zelle

Since his days of running afoul of the law, Abagnale has become an authority on forgery, embezzlement, secure documents, cybercrime, and scams. He has also lectured at the FBI Academy.

“All I care about is that I have the ability to monitor my own credit,” he said. “And if I can monitor my credit, I can save myself a lot of problems.”

Trust, but always verify

If something seems suspicious—don’t click, call, or respond. Look up the official source and confirm it yourself.

“Whether you’re dealing with cybercrime or identity theft, you need to know who is on the other end of that device,” Abagnale said. “Before you part with any money or information, you can save yourself a lot of misery by simply verifying that this is indeed the real person.”

So don’t click any links in a suspicious email or text. If it’s from Amazon, for example, open a new browser and type “Amazon.com” directly. Then check your account for issues.

If an email or text includes a phone number, don’t call it. Look up the real number yourself — or if it’s about a credit card, use the number on the back of the card.

Knowledge is power: Stay updated on the latest scams

Scams change quickly — the best way to stay safe is to keep learning how they work.

Two new scams to watch

Keep your guard up for these trending cons:

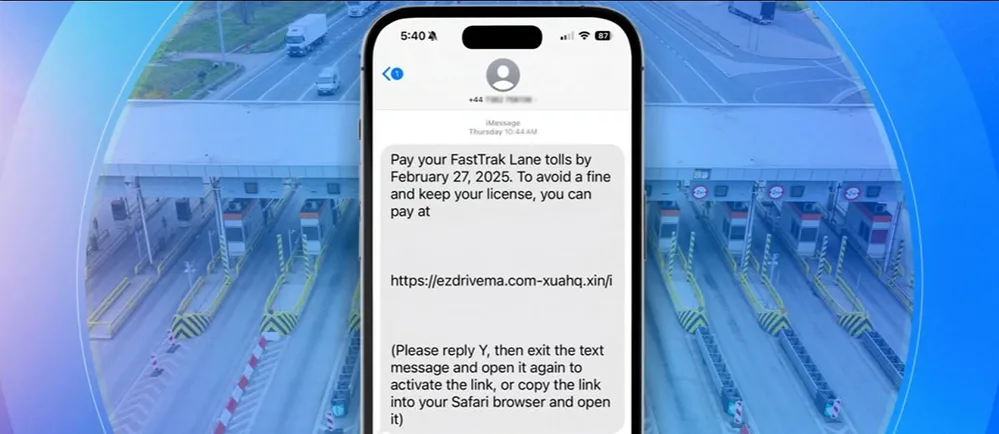

- Fake toll payment messages—messages claiming you owe highway tolls, often with urgent links

- “Oops, wrong number” texts—casual, friendly-seeming messages designed to lure you into a scam.

Click here to read our full article on how these scams work—and how to protect yourself.