Starting September 30, 2025, Social Security will stop mailing paper benefit checks to most recipients. This change affects about 1% of current beneficiaries who still receive physical checks. Here’s what Social Security expert David Freitag explains about making the transition to electronic payments.

The Social Security check is not in the mail!

fyi50+: There was an announcement from the Social Security Administration that they are not going to be sending out benefit checks anymore. What is happening?

Freitag: Well, Heidi, that headline “The Social Security Check Is Not in the Mail” is a bit misleading. The SSA has announced that it will not be sending out physical checks to members after September 30th of this year. The new rule is that benefits will be processed via direct deposit into a bank account. This is a good thing. Currently, only about 1% of the benefits are paid by mailed checks. So, for most people, this will not be a big change. However, for those expecting a check, that will stop.

Payment exceptions

fyi50+: Are there any exceptions to this new rule?

Freitag: Actually, there are a few exceptions. First, if the member is 90 years or older, they can continue to receive a physical check. Second, if a member does not have a bank account, the SSA can send out a Direct Express prepaid debit card. There is a helpful website link on SSA.gov that can assist with transitioning to fully electronic processing of benefit checks.

Social security transition to electronic payments—what beneficiaries receiving paper checks need to know | ssa

Remember that you need to proactively make these changes to your account if you don’t want to miss a check.

Setting up direct deposit

fyi50+: What is the best way to set up a direct deposit account?

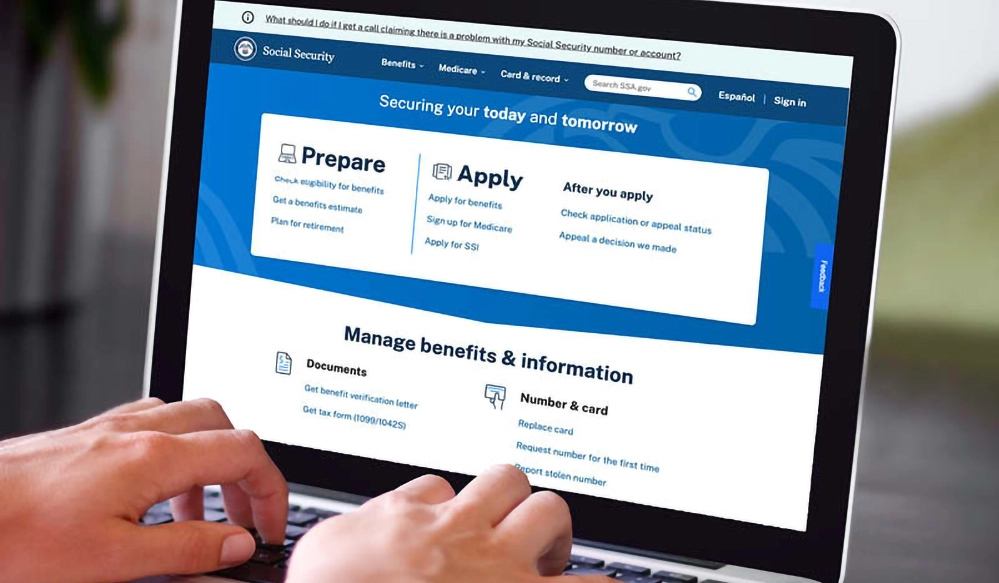

Freitag: That all begins with creating a myAccount on SSA.gov. Once you have a myAccount, setting up direct deposit to a bank account takes just a few minutes.

In addition to receiving the money, there are two other very important reasons to have a myAccount with the SSA. The first reason is account service—with a myAccount, many tasks that used to require a call to the SSA 800 service line can now be done online. You can request a replacement card, upload documents directly to the SSA, get benefit estimates, and access needed tax forms. Click here to learn how to set up an account.

Protecting against Social Security scams

Freitag: The second reason you need a myAccount is to protect your records from identity thieves. Since the start of COVID, scammers have been trying to access Social Security records and trick workers into schemes that reveal bank account numbers and other personal data about their assets.

fyi50+: We have discussed the importance of a myAccount before, but scams are becoming so common. How does having a myAccount protect personal data?

Freitag: That’s a good thing we have tackled this subject before. Also, the identity thieves are becoming more aggressive these days as they try to steal your personal data. With a myAccount, an individual username and a unique password are in place to make unauthorized access much more difficult. Plus, accessing a myAccount now requires two-factor authentication to make it an even more secure process.

fyi50+: Are there any other reasons to have a myAccount?

Freitag: Yes. With an active myAccount, you can easily check your contributions to the program. Remember to check those contributions at least annually! If there is a mistake, it could result in lower retirement payments someday in the future.

Common questions about the changes to Social Security payments:

Q. When will paper checks for Social Security end?

A: Paper checks end on September 30, 2025, except for recipients aged 90 or older, who can continue to receive physical checks.

Q. What if I don’t have a bank account?

A: You can receive a Direct Express prepaid debit card instead of direct deposit to a traditional bank account.

Q. How do I set up direct deposit for my Social Security benefits?

A: Create a myAccount at SSA.gov, then set up direct deposit online in just a few minutes through your secure account dashboard.

Q. Will this change affect my benefit amount?

A: No, this only changes how you receive your benefits, not the amount you’re entitled to receive.

While change can feel overwhelming, taking a few minutes now to set up your myAccount and direct deposit ensures you won’t miss a beat when September 30th arrives. The transition to electronic payments isn’t just about convenience—it’s about security, efficiency, and staying connected to your benefits in our digital world.