Scamming 101: Common red flags and how to prevent fraud

As we covered in this space a while back, the ways bad guys take advantage of us are constantly changing.

New technology gives scammers new tools, but the tactics behind them remain largely the same.

Scam Tactics: recognizing fake urgency and high-pressure tricks

According to scam expert Frank Abagnale, one tactic is asking that money be handed over immediately. (If that name sounds familiar, it’s because he was portrayed by Leonardo DiCaprio in the film “Catch Me If You Can.” The movie is based on the book of the same name, which Abagnale co-wrote.)

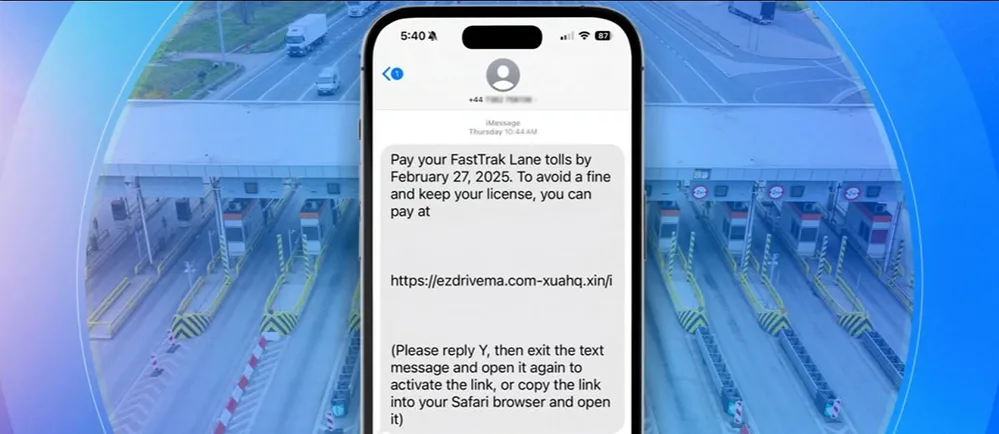

You’ll see the same fake urgency with the scam involving unpaid highway tolls. A similar example is someone claiming to be from the IRS demanding unpaid taxes immediately.

A third example is the scam involving a grandchild who needs to post bail now, or they’ll spend the weekend in jail. “If the father or the grandparent says: ‘Look, I live one block away; let me just walk down to the sheriff’s office, and I’ll pay the bond.’ [And they reply:] ‘No, you can’t do that. You have to give me a credit card over the phone.’ … Right there, that’s a huge red flag,” said Abagnale, who also wrote the book “Scam Me if You Can.” Another, he added, is being asked for sensitive data such as personal or financial information.

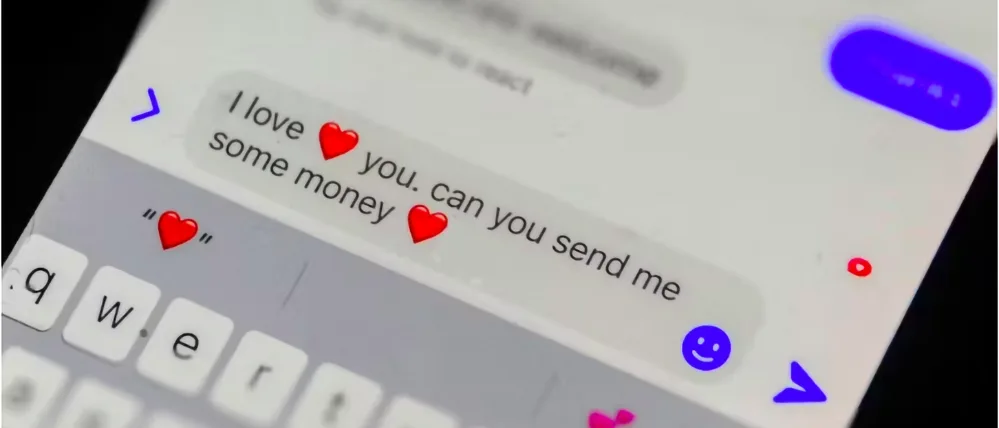

“Under the Ether “: romance scams and emotional manipulation

Abagnale also warns of something he calls “putting people under ether,” or charming a target into thinking that the scammer is worthy of a target’s trust or even their love. Some scammers can be so charismatic that a target, even when confronted with evidence to the contrary, will insist that the scammer is not taking advantage of them.

“Once they go under the ether, there’s no coming back,” said Abagnale, “no matter what you say, no matter what you tell them.”

The so-called “ether” can appear as good news out of the blue — such as being told that you have won a contest that you don’t remember entering. For instance, the promise of a fancy new car can be too intoxicating for some to snap back into reality. “It amazes me how many very intelligent people — doctors, lawyers, and business professionals — fall for these scams,” he said.

AI-driven scams: how artificial intelligence is changing fraud

Scammers are not great writers or editors; their misspellings and grammatical errors can serve as additional red flags. However, the increasing use of artificial intelligence tools presents a new challenge, as they can make emails, texts, and documents look more convincing.

“I mean, I go back to the days 50 years ago when I was replicating documents,” Abagnale said. “I had to use paste letters, cut and paste, and then I had to take an IBM typewriter and type over and over the name of the bank or the company to make it look like it was printed. Then, I had to get airplane models, soak them in a tub to get the decal off, and put it on the check to make it look like a color-printed logo. And today, you can sit down at your computer, and you can digitally, through AI, recreate any credential or website or lookalike.”

However, AI tools can have limitations, said Michael Skiba, also known as “Dr. Fraud“. Something like ChatGPT might get spelling and grammar right in a scam text or email, but its writing “style,” so to speak, will appear a little off.

“It’s going to get the structural things,” Skiba said. “But it’s just the flow of how it sounds.”

Scam prevention tips: how to protect your identity and finances

Since his days of running afoul of the law, Abagnale has become an authority on forgery, embezzlement, secure documents, cybercrime, and scams. He has also lectured at the FBI Academy on these topics.

His philosophy for thwarting the bad guys has three elements: prevention, verification, and education.

For instance, a few ways to prevent being scammed include freezing your credit and freezing the credit of others in your family if they are not looking to buy a car or a house.

“You don’t need to have your credit exposed to where people can get it,” he said.

Sign up for a credit monitoring service. These services will alert you if someone uses your Social Security number or a new bank account is opened in your name. Ensure it monitors all three credit bureaus: TransUnion, Experian, and Equifax. Abagnale also recommended selecting a service that notifies you in real-time if someone attempts to use your credit.

“All I care about is that I have the ability to monitor my own credit,” he said. “And if I can monitor my credit, I can save myself a lot of problems, and a lot of things are not being ripped off.”

Abagnale also recommends not using a debit card.

“The safest form of payment in the United States is a credit card,” he said. “Even if someone charges a million dollars to my credit card tomorrow, by federal law, I am not liable for a dime of that money.”

That’s not the case with a debit card, he said, because every time you use it, yo u’re exposing the money in your account.

“Even if you’re sending money through Venmo, don’t back that with your bank account,” Abagnale said.

“Don’t back that with your debit card because, under the law, that’s a cash transaction. Once you lose your money, it’s gone. But if you backed it with your credit card, you could always fall back on your credit card company to recover your money.”

Verify before you trust: spotting scam emails, texts, and calls

“Whether you’re dealing with cybercrime or identity theft, you need to know who is on the other end of that device,” Abagnale said.

“Before you part with any money or any information, you can save a lot of misery by simply verifying that that is the real person, whether it takes a phone call or checking on it before you part with any money.”

So don’t click any links in a suspicious email or text. If it’s from Amazon, for instance, open a new browser window and type in “Amazon.com.” Then go to your account and see if there is a problem with a delivery or payment.

If the sketchy email or text tells you to call a number, don’t — especially if it’s a link. Instead, look up the relevant number online and call it.

Or, in the case of a credit card situation, dial the number on the back of the card.

Scam awareness: educate yourself to avoid fraud

Finally, educate yourself about the latest scams that are out there.

“Education is the most powerful tool to fighting crime,” Abagnale said.

“If I can show you how the scam works, and you understand it, then obviously you won’t fall for the scam.”

Outsmart the latest scams before they outsmart you

Fake toll payment texts (“smishing”) and long-con financial schemes (“pig-butchering”) are deceiving even the savviest consumers. Learn the warning signs, how these scams unfold, and simple ways to stay protected — read the full Scam Alerts breakdown at www.fyi50plus.com.

Stay alert. Stay protected.