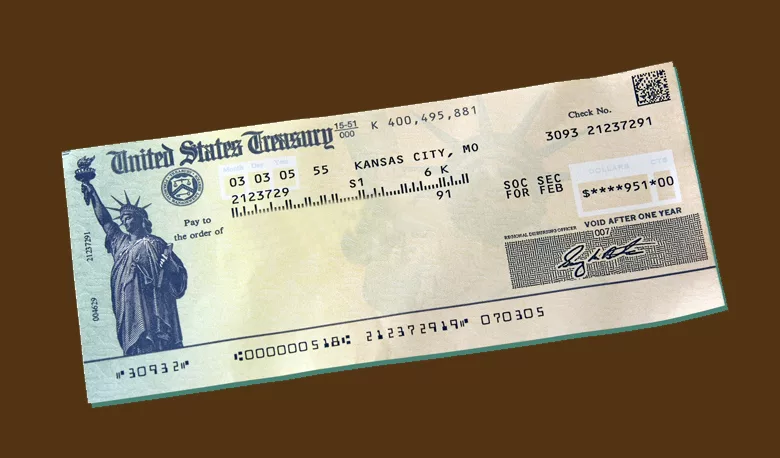

Retirement

Keep Informed on Important Changes to Social Security and Medicare

Each year the Social Security Administration announces small incremental changes to both the Social Security program and the Medicare program.

These changes are built into existing Social Security and Medicare rules that do not require any advance Congressional approval. Although these changes seem small when considered one at a time, in reality, these changes can make a difference in your budgeting plans for retirement. For 2019, here are the most important changes:

- The COLA adjustment for 2019 increased benefits by 2.8%. This is the largest increase in the past seven years. By comparison, the increase for 2018 was 2.0%

- The maximum full retirement age benefit in 2019 increased to $2,861. This represents an increase of $73 a month for workers who file for benefits at full retirement this year.

- The Social Security wage base increased to $132,900 in 2019 up from $128,400 in 2018. For workers with incomes over $128,400, this is a tax increase of $344.25 for the worker and $344.25 for the worker’s employer.

- Full retirement age for people born in 1957 is 66 years and 6 months. This increase in full retirement age reduces benefits by 27.5% if you elect to take the money at age 62.

- It cost more to earn a Social Security credit in 2019. The new amount is $1,360 which is up $40 from 2018. Remember that it takes 40 credits to qualify for retirement benefits.

- The earnings test for workers who claim benefits before full retirement age increased to $17,640. After you reach that amount, for every two dollars over $17,640, one dollar in benefit is withheld.

- Medicare Part B and Part D premiums have increased slightly over premiums in 2018 for most beneficiaries. However, high-income people with Medicare benefits could pay more for their health insurance in 2019 than in 2018.

It is important to keep up to date with these changes to Social Security and Medicare.