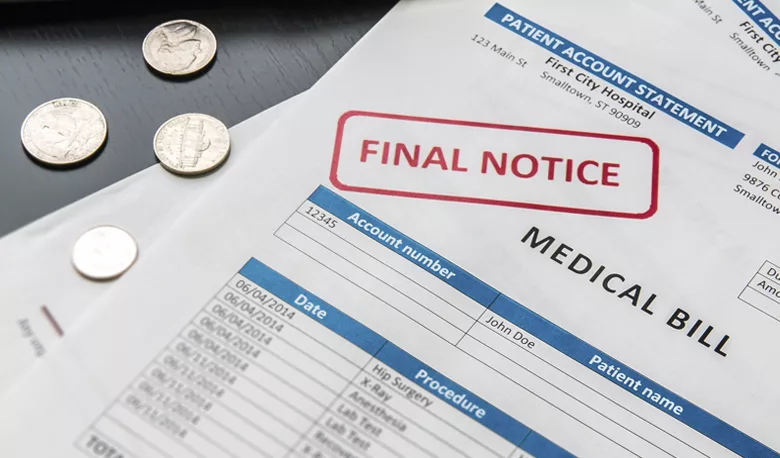

A Guide to Combat Medical Debt

By Aly J. Yale ~

Overwhelming medical debt is the No. 1 reason Americans file for bankruptcy. In fact, according to a study out of the City University of New York, 66.5 percent of bankruptcy filings cite medical expenses as a contributing factor.

These expenses often stem from emergency room visits or surgeries, costly bills after life events (the labor of a child, for example), or treatments for fertility or chronic illness. Regardless of their source though, they pose a severe financial burden for the everyday American.

Not only can costly medical debt make it difficult to pay household expenses, like rent, utilities, and grocery bills, but getting behind on those bills can mean a lower credit score, a constant barrage of calls from collections agencies or, in dire situations, even a filing for bankruptcy.

Are your sky-high medical bills forcing you to consider bankruptcy? This guide can help you find medical bill assistance programs, walk you through the bankruptcy process and help get your credit back in good standing.

Dealing with Medical Debt

Having a stable emergency fund or Health Savings Account is vital in the event an unexpected medical cost arises. Unfortunately, most people don’t have these funds at their disposal.

According to the Federal Reserve, nearly half of all Americans don’t have the cash to cover a $400 emergency expense. And many of those people said they’d need to finance the bill to pay it off.

If you’re currently without an HSA or flush emergency savings fund, it’s essential you take steps to prevent unexpected medical costs where possible. To do this, call doctors and hospitals ahead of time to confirm they’re within your insurance provider’s network. You should also ask about how the charges will be coded at the doctor’s office and connect with your insurer to be sure these are covered expenses.

When a medical bill does arrive, take this step-by-step approach to tackle it:

1. Make sure you understand the medical bill.

First, is it a bill or an Explanation of Benefits? An Explanation of Benefits (EOB) is simply a statement from your insurance company explaining what medical services were covered (and how much they contributed.) Since you’ll be responsible for any remaining balance past that, you will usually receive an EOB first, and then the actual bill later. That bill should come directly from the provider or hospital system to whom they are working.

Second, look at the line-item charges and be sure they’re accurate. If something looks off or says that your insurance company did not cover it, call them up and get the details.

2. Negotiate the debt.

Once you are aware of the medical costs, try and negotiate the charges at that time. If you do not feel you can afford the full cost of the services you need, ask early on about reduced fees or the option of a payment plan.

Providers may still negotiate with you after the bill is issued. Consider asking for a reduced fee in exchange for paying the bill off ASAP or setting up a repayment plan that spreads your costs across several months or years.

Other tactics that might work:

- Offer cash. Credit cards come with fees and cost the provider more to process.

- Ask for insurance rates. Medical providers offer reduced fees for different insurers. See if your doctor will let you pay the reduced price of one of their insurance clients.

- Do your research. Use the Healthcare Bluebook to gauge the average cost of the care you received. If something doesn’t align with your bill, negotiate to pay only the Bluebook value.

3. Consolidate the debt.

If your medical debt has started to become overwhelming or you’ve fallen behind on your bills, it’s time to consider consolidation. Consolidation combines all your debts into one single account, allowing you to pay just one bill per month, ideally across many months or years. You can do this by putting the debts on a high-balance credit card or taking out a loan. Keep in mind that even if your credit score has dropped due to your unpaid debts, there are bad credit loans that can help.

4. Consider an income-driven hardship plan.

Income-driven payment plans are available to Medicaid participants with low income. They function like standard re-payment plans in that they spread your medical debt across smaller monthly payments over time. In some cases, providers may even reduce your debt if you’re on one of these plans. Because of this, you’ll want to consider an income-driven hardship plan immediately — as soon as your medical bills arrive.

Getting Help

There are many programs and providers that will help with medical assistance for free or for reduced costs to those with financial hardship. The United Way can help connect you with some of these services in your area, or you can look to the National Association of Free & Charitable Clinics or NeedyMeds.org, which details medical assistance programs by state. Many of these programs also offer bill advocacy to help reduce and negotiate existing medical debts.

Other forms of assistance you might want to consider include:

Medical bill advocates.

A medical bill advocate is a person who works independently of any insurance agency or healthcare provider. They work on your behalf to analyze your medical bills and negotiate them directly with providers and hospital systems. They usually come at a fee (a percentage of the amount they save you, in most cases). Popular options for medical bill advocates include the National Association of Healthcare Advocacy Consultants and the Alliance of Claims Assistance Professionals.

Help from family and friends.

You can also ask loved ones for assistance. If you’re not comfortable asking directly, consider setting up a campaign on a crowdfunding platform like GoFundMe or PlumFund.

If you still can’t pay your medical bills

Despite all these sources of help, you might still be unable to pay your medical bills — and you wouldn’t be alone. Medical bills are one of the most commonly collected on debts in America. According to the Kaiser Family Foundation, 52 percent of debt collection actions in our country contain some form of a medical bill.

Unfortunately, if you’re unable to pay your medical expenses, this likely means you’ll have collections agencies at your door as well. Dealing with collection agencies isn’t just annoying, but it can have a severe impact on your credit score, too. Having a single debt in collections can ding your credit by 100 points or more.

Dealing with Collections Agencies

If you’re dealing with debt collectors, make sure you know your rights. You should also record every call you have with a collector and get other communications in writing if possible. If you ever feel your rights are violated, consider enlisting an attorney to represent you.

Filing for Bankruptcy

In the event you’re unable to negotiate or settle your medical bills, filing for bankruptcy may be your only financial option. And the sooner you file, the better. Bankruptcies stay on your record for seven years, and they can have a significant impact on your financial options during that time period. The quicker you’re able to file, the faster you can get on the road to recovery, financially speaking. In medical debt cases, Chapter 7 bankruptcy is often the best route to take. Chapter 7 bankruptcy allows you to wipe medical bills and other unsecured debts clean, while still keeping the majority of your property and assets intact.

Recovering Your Credit

After you’ve filed for bankruptcy and eliminated your medical debt, you’ll need to work hard to get your credit back in good standing. That means paying your bills on time, every time, and avoiding big purchases or risky new debts. You also might consider:

- Securing a 0% interest credit card.This will help you build up credit without costing you lots in interest.

- Taking out a personal loan. Use a personal loan to cover everyday expenses and pay it back over time.

- Use a secured card. Visit your bank and inquire about a secured card. It requires an up-front cash deposit, but it can be a great way to boost your credit if you’re unable to secure a card or loan elsewhere. Some banks also offer credit-builder loans you can consider.

- Become an authorized user on a loved one’s account.Have a friend, spouse or family member with excellent credit? See if they’re willing to let you be an authorized user on their card or bank account.

Finally, give it time. It takes a while to build credit, and even more when your credit has taken a major hit. Pay your bills on time, avoid expensive new debts and commit to long-term fiscal responsibility, and your credit and credit score will recover in no time.