With more life experience comes more familiarity with financial stress, but that doesn’t automatically make it any easier to navigate. A recent report from the University of Michigan Institute for Healthcare Policy and Innovation found that more than half of adults over 50 felt stress about their personal finances in the past year, and 16% of that group felt “a lot” of stress.

Reeling from financial stress is a matter of mental and physical well-being. During this Healthy Aging Month, it’s critical older people and their families are better equipped to manage the day-to-day challenges of financial strain. Consider the following tactics to start regaining control.

Reach Out for Support

Financial stress is incredibly common and a challenge no one should take on wholly alone. Reaching out to your friends and family for emotional support is an important first step because this is a challenge that most in your personal network have encountered at some point. Leaning on loved ones for support can include areas outside of finances. For example, encouraging physical health through shared activities can make things feel less heavy while you prepare to catch up financially.

Keep Your Family on the Same Page

Collaboration on financial wellness is critical for family members with financial ties. All parties have an interest in resolving issues, especially if you’re a caregiver or if one or multiple family members share care responsibilities. As of 2022, Americans over 50 spent an average of $7,020 on healthcare annually, according to the Bureau of Labor Statistics, creating ample opportunity for conflict.

Arguing is all too common and can compound existing stress. Instead, consult third-party professionals or other resources that can intervene when tensions arise. Creating an environment where healthy communication and better documentation are possible opens the door for more long-term success.

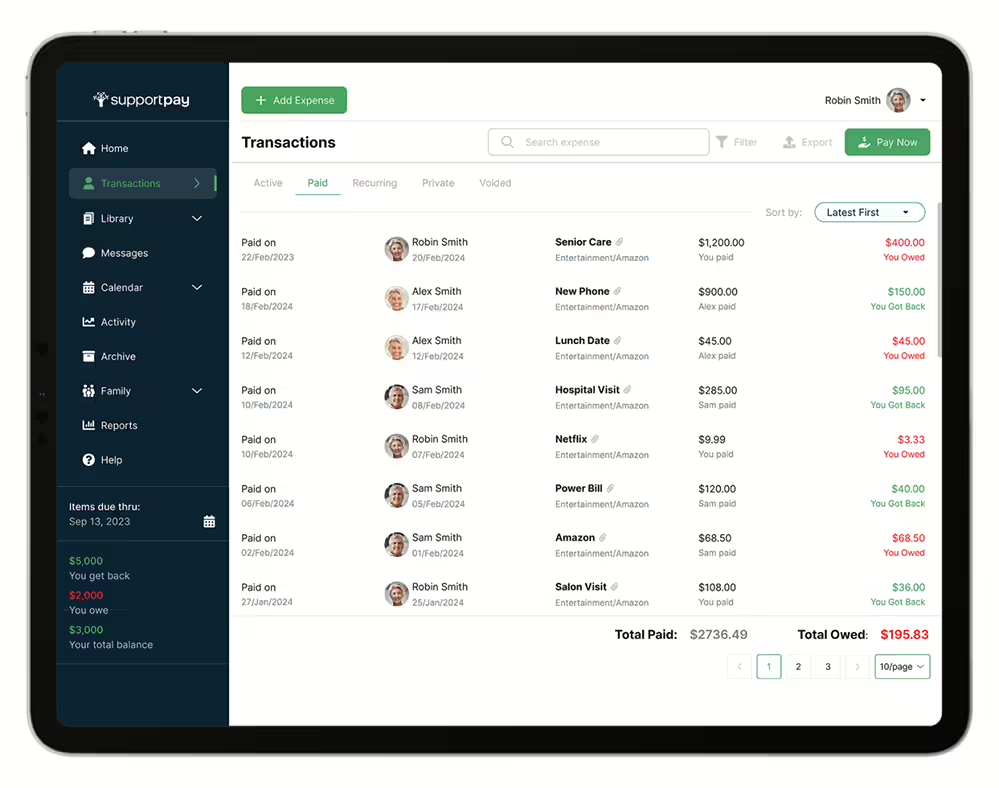

Use Technology to Your Advantage

There’s a host of applications available to support financial management. It’s best to look for all-inclusive financial solutions that meet a diverse set of multiple needs: expense management, banking, document management, or communication. Automation can also save you time, freeing up more focus for taking care of yourself. Technical involvement centralizes and streamlines processes, saving time and energy better spent caring for oneself and others.