Are You Sabotaging Your Family?

How to Put Your Affairs in Order.

Most people don’t intend to make things difficult for their families. Indeed, most mature adults I speak with emphatically say they don’t want to be a burden.

Despite this, they may be guilty of sabotaging their families.

Here are some common mistakes impacting important personal and financial affairs and how to avoid them:

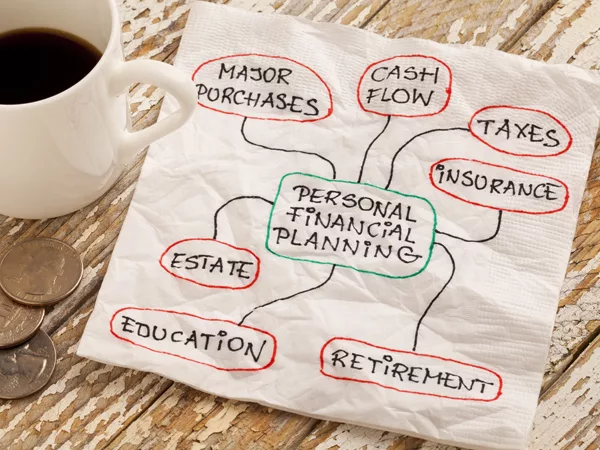

1. You don’t discuss money.

Many of us grew up not discussing family finances. But your family needs to know the details. Share with your family where you hold your assets and introduce them to your financial advisor. Get in place a valid Power of Attorney so a trusted individual can help with your finances if necessary.

2. You don’t discuss health issues.

Sometimes people resist sharing information about their health: They either don’t want to complain or don’t want to receive unsolicited advice. However, if your family doesn’t know what health conditions you have or receive treatment for, they will be ineffective in assisting with your care. Worse, they could inadvertently exacerbate a health issue. A firefighter suggested everyone attach a list of their medications to the refrigerator, so this critical information is available in an emergency.

3. You don’t discuss funerals.

Nobody likes facing this reality. Unfortunately, it is a statistical certainty you will die. Planning for this in advance only makes the transition less stressful for your family. Share your wishes with your family and let them know if you have a prepaid funeral plan or burial plot. Ensure they will have access to money to pay your funeral expenses.

4. You don’t have a will.

One of the easiest ways to frustrate your family is to not have a will. When someone dies without one, the legal process to get access to their money, pay their bills, and distribute their assets to their heirs is a long and expensive ordeal. This is especially the case if you have a blended family. If you love your family, please get a licensed attorney to draft your will.

5. You hold accounts at multiple banks.

We all love a good puzzle but spreading your assets over numerous accounts with different financial institutions only makes managing them more difficult. You can diversify your portfolio without opening too many accounts. Consolidate your accounts to the greatest extent practicable. Additionally, if you have old 401(k) accounts with former employers, consider consolidating those into one rollover IRA.

6. You don’t file taxes.

Not only do you risk interest and penalties when you fail to timely file and pay your income taxes, but you also subject everything you’ve spent a lifetime working for to potential seizure by the IRS. Hire a competent CPA to help you catch up on any prior-year tax returns.

7. You take out a reverse mortgage.

Reverse mortgages may have appeal but pay attention to the terms. Most reverse mortgages require a full pay-off within a very limited time period —some in as little as 30 days — after the borrower dies. In many cases, the home needs to be sold quickly, lest the family lose the home’s equity. I’ve seen many instances wherein the mortgage company doesn’t even provide enough time for an executor to be appointed by the court before they foreclose on the reverse mortgage.

8. You keep all your mail.

If you really want to provide a wild goose chase for your family, keep every piece of mail you’ve received for the past decade. I frequently see people keep unimportant mail alongside the important mail in indiscriminate piles. If a family member needs to help take care of your finances or your estate, please don’t make the task more difficult. There is seldom a need to keep bank statements which are more than three years old. And you certainly don’t need to keep old coupons. Do yourself and your family a favor and purge the old unnecessary mail.

Most of us are guilty of at least one of the behaviors from this list, but it’s not too late to get your affairs in order. Not only will you make things easier for yourself, but you’ll also make them easier for your family.